Motorcycle Sales Figures

January 1 through December 31, 2022

Australia

FCAI Motorcycle Sales Figures

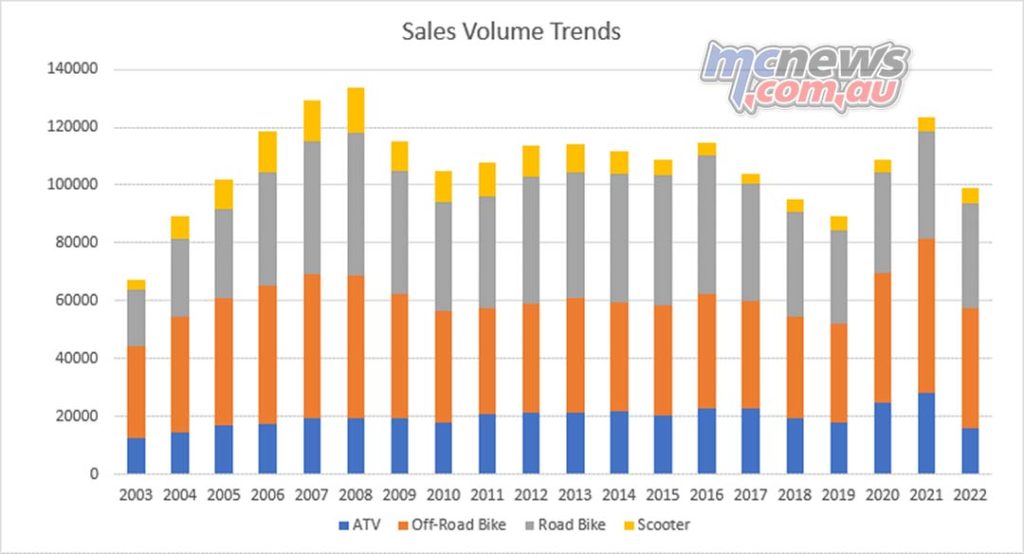

- 2022 Total Sales – 99,030

(2021 was 123,530) Down 19.8 per cent - 2022 Total Road Sales – 36,208

(2021 was 37,270) Down 2.8 per cent - 2022 Total Off-Road Sales – 41,681

(2021 was 53,118) Down 21.5 per cent - 2022 Total Scooter Sales – 5316

(2021 was 4821) Up 10.3 per cent - 2022 Total OHV/ATV/SSV Sales 15,825

(2021 was 28,321) Down 44.1 per cent

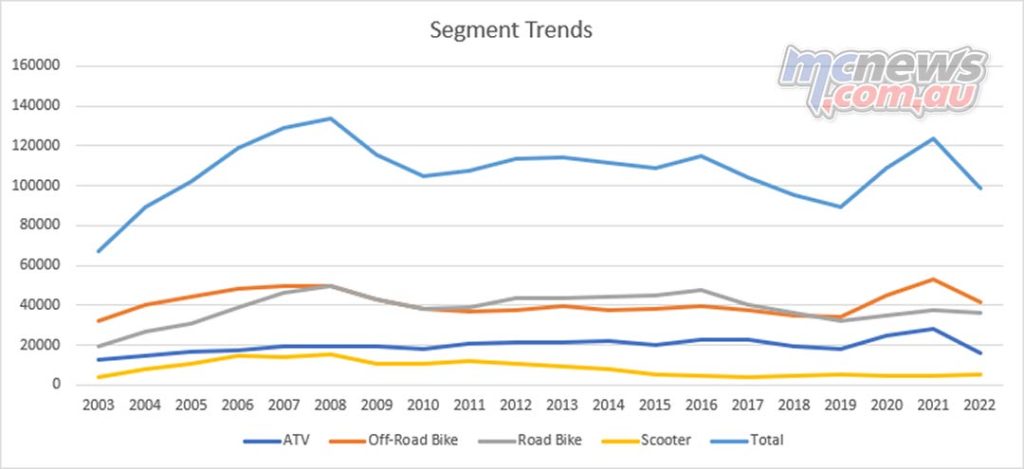

A total of 99,030 motorcycles and OHVs were sold in 2022 according to the FCAI.

This represents a decrease of 19.8 per cent compared to a bumper year in 2021.

There are still supply chain issues across the board, along with freight problems constraining sales somewhat but both 2020 and 2021 were very good years for sales, thus a contraction was always likely.

Many brands are not included in the FCAI audit (see further explanatory notes bottom of page), and MCNews.com.au believes the real figure would likely exceed 125,000 units if those other brands were included.

Off-road motorcycles accounted for 42,1 per cent of overall sales, equating to 41,681 units sold. This is a decrease of 21.5 per cent on 2021 figures.

Road motorcycles were the next most popular segment, recording 36.6 per cent of sales with 36,208 units sold. This represents a decrease of 2.8 per cent on 2021 figures.

The OHV segment of the market decreased by 44.1 per cent. This amounts to a total of 15,825 units sold representing 15.9 per cent of the overall market. This decrease is due largely to Government policy mandating the fitment of operator protection devices (OPDs), which has led many manufacturers to cease supply of agricultural all-terrain vehicles (ATVs) to the Australian market. The fact that some of the biggest movers of vehicles in this category are now sold by CFMOTO, whose data is not included in the FCAI figures, does indicate that the contraction is likely not as dramatic as the FCAI data suggests.

Scooters made up the smallest portion of the market with 5316 new units sold equating to 5.4 per cent of total sales. However, this figure is an increase of 10.3 per cent on 2021 figures.

This is not the full picture

Unfortunately these are the only figures we now receive from the official sales audit. Historically we would be able to see brand by brand and model by model performances, but the FCAI aligned brands now hold their cards close to their chest and refuse to release detailed data which is why of late you have not seen the regular detailed motorcycle sales figures analysis by model segment and model that we generally brought to you each quarter on MCNews.com.au. New Zealand have a transparent mechanism with public reporting of registration data on a monthly basis but here it has all gone a bit secret squirrel.

It should be noted that some brands are not represented in the official audit figures in relation to motorcycle sales. Their reticence to release their figures to the audit body and be part of the FCAI seems to be the catalyst for the FCAI brands now releasing only very limited data, seemingly to not reveal any market intelligence to the brands not aligned with the FCAI.

Brands under the Urban Moto Imports group such as Royal Enfield, Benelli, MV Agusta, Segway and Rieju are not included in the FCAI audit.

Likewise, the likes of CFMOTO, Kymco, Sherco and Landboss that come under the stewardship of Mojo Motorcycles, are not included in the sales figures as these companies are not members of the Federal Chamber of Automotive Industries.

With the quoted 99,030 total sales in the Australian market not including sales from those brands the real figure is quite likely in excess of 125,000.